Indicators on Do I Have To List All My Debts When Filing Bankruptcy in Virginia You Should Know

Shopping online has its benefits. It's super easy, but it could be time consuming to find the very best offers. Rather than searching for coupon codes (that don't constantly function!) and opening tons of browser tabs comparing rates, you are able to test Funds 1 Procuring.

It is usually recommended that buyers seek advice from with a certified financial advisor just before taking over a consolidation bank loan.

We aim to offer worthwhile content and valuable comparison options to our people by our totally free on the web useful resource. It is vital to note that we acquire promotion compensation from firms highlighted on our web page, which influences the positioning and order during which makes (and/or their goods) are shown, plus the assigned score. Make sure you bear in mind that the inclusion of organization listings on this website page will not suggest endorsement.

The organization submitted for bankruptcy defense in Texas in May well and designs to sell off all of its hospitals.

When you’re printing out the bankruptcy types, make sure you signal almost everywhere you must indicator. It’s also a smart idea to make copies for your personal data. If you take an extra duplicate to the court when you file the court can stamp your assigned situation selection on to your copy.

By submitting this way you comply with acquire email messages from FinanceBuzz and to the privacy coverage and phrases. Trending Articles

Significant: To get the most out of this exceptional offer, begin building buys along with your new debit card within just forty five times of opening your account. You’re shelling out your charges in any case, so why skip out on the opportunity to get paid cash back?

org differs than other providers during the Area. Credit score.org delivers a completely cost-free personalized financial overview in conjunction with an action approach that empowers you for making smarter choices about your choices to be financial debt free. Your Domain Name Additionally, they will help you manage your financial debt by way of personalized options.

Not Absolutely everyone can defend all in their possessions in Chapter seven. Sometimes the trustee sells a number of your house within an asset situation.

*Acceptance and personal loan phrases range according to applicant qualifications. Not all applicants will qualify for the complete amount of money or lowest accessible charges.

The time period and APR will rely on the asked for loan amount of money, your creditworthiness, revenue, personal debt payment obligations, credit historical past and other components. There isn't any promise that you'll web link be experienced to get a financial loan as a result of our affiliate marketers or companions. Financial loan solutions may not be obtainable in all states.

We wholeheartedly really encourage study and Discovering, but on line content articles can't deal with all bankruptcy challenges or maybe the information of your respective circumstance. The obvious get redirected here way to protect your assets in bankruptcy is by my link choosing an area

You'll ought to have a certain degree of credit card debt for being eligible for personal debt reduction, which may differ As outlined by which relief assistance you decide on. Some require a least unsecured financial debt of $7500, while some specify that you need to owe not less than $10,000.

This chapter with find out the Bankruptcy Code presents for adjustment of debts of an individual with normal cash flow. Chapter thirteen allows a debtor to keep property and spend debts with time, usually a few to 5 years.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Neve Campbell Then & Now!

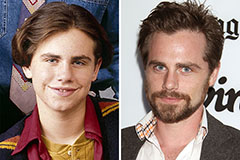

Neve Campbell Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!